GetApp offers objective, independent research and verified user reviews. We may earn a referral fee when you visit a vendor through our links.

Our commitment

Independent research methodology

Our researchers use a mix of verified reviews, independent research, and objective methodologies to bring you selection and ranking information you can trust. While we may earn a referral fee when you visit a provider through our links or speak to an advisor, this has no influence on our research or methodology.

Verified user reviews

GetApp maintains a proprietary database of millions of in-depth, verified user reviews across thousands of products in hundreds of software categories. Our data scientists apply advanced modeling techniques to identify key insights about products based on those reviews. We may also share aggregated ratings and select excerpts from those reviews throughout our site.

Our human moderators verify that reviewers are real people and that reviews are authentic. They use leading tech to analyze text quality and to detect plagiarism and generative AI.

How GetApp ensures transparency

GetApp lists all providers across its website—not just those that pay us—so that users can make informed purchase decisions. GetApp is free for users. Software providers pay us for sponsored profiles to receive web traffic and sales opportunities. Sponsored profiles include a link-out icon that takes users to the provider’s website.

3 benefits the rise of robo-advisors will bring for small financial advisory firms

The rise of robo-advisers has disrupted wealth management in the last decade. Learn how small financial-advisory firms can use robo-advisers to gain more market share.

Would you trust a robot for financial advice?

Not the fictional “robots” you see in sci-fi movies or read about in articles on advanced artificial intelligence (AI) that predicts the future. We’re not there quite yet!

The robots we’re talking about are digital wealth management platforms called robo-advisers. They are increasingly being used by tech-savvy millennials to maximize their investment returns.

This trend shows us that small financial advisory firms need to be prepared to tackle the diverse financial requirements and service expectations of millennials.

By utilizing the latest fintech (financial technology), such as robo-advisers, your small, independent advisory firm can create accurate financial plans for a diverse demographic. They’re also a low-cost way to increase client retention.

Here’s why this technology matters: After the 2008 financial crisis, robo-advisers have revolutionized the wealth management industry. They provide an automated means for matching the financial requirements of an individual’s investment portfolio based on complex algorithms.

In this article, we define robo-advisers and look at how small and independent financial advisory firms can benefit from this technology.

What we'll cover:

Robo-advisers: The rise of invisible wealth management machines

3 key benefits of robo-advisers for small and independent financial advisory firms

Recommended actions

Additional resources

Robo-advisers: The rise of invisible wealth management machines

What are robo-advisers?

Robo-advisers are algorithms that map a client's financial profile to the best returns for stock market investments, educational savings, retirement accounts, etc., with very limited or no human intervention.

The word “robo-advisers” is a combination of the words “robot” and “financial advisers.”

They are also referred to as digital wealth management software or automated investment applications. These tools are offered as cloud and web-based applications that can be accessed from multiple devices such as desktops and smartphones.

Google Trends data on the rise of robo-advisers over 10 years; Google searches for “robo-advisers” peaked in 2017

Robo-advisers are similar to the invisible “robots” hard coded into computer applications that automate tasks using algorithms. In the past few years, these robots have disrupted the process of solving critical business challenges in both small and large businesses.

In the wealth management industry, the number of robo-advisers has risen exponentially in the United States. Globally, assets under management (AUM) through robo-advisers will be approximately $1 trillion by 2020; this number is forecast to increase to $4.6 trillion by 2022.

How do robo-advisers work?

Robo-advisers work autonomously to select investment types (stock, retirement planning, etc.) based on the individual profiles.

If you’re considering employing robo-advisers at your small business investment firm, here are some features to look for:

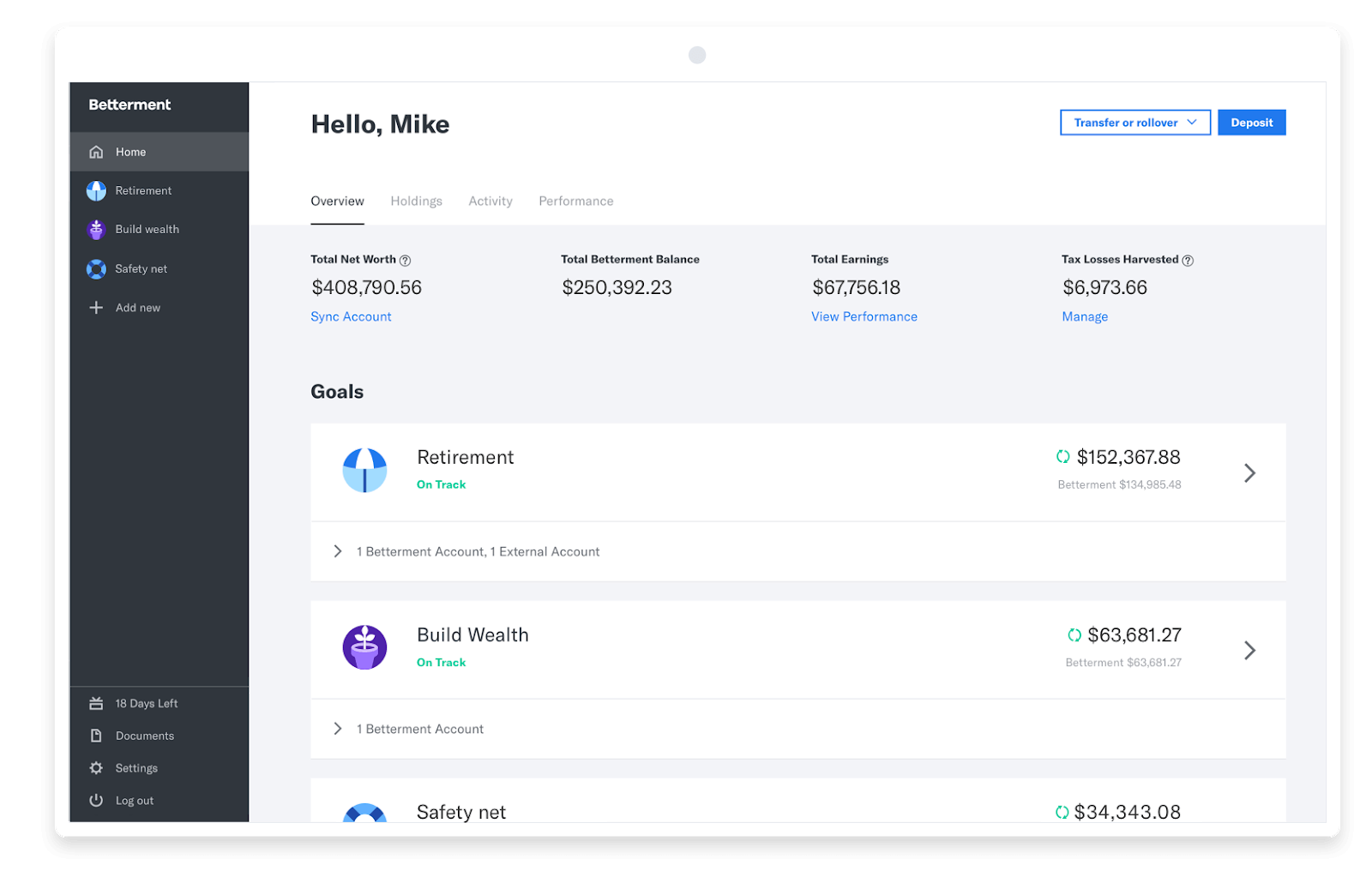

Investment dashboard: Provides a holistic view to investors of total investments under various portfolios.

Algorithmic core: Investments are made through algorithmic trading platforms that measure the best investment returns in real time.

Portfolio management: Manage both short- and long-term investment portfolios to balance the risk of investing in high-risk assets such as stocks.

Investor profiling: Using questionnaires and surveys, robo-advisers create an investor profile to match investment requirements.

3 key benefits of using robo-advisers for small and independent financial advisory firms

1. Offers cost savings with diversified wealth management portfolios

For small and independent firms, the biggest difference between robo-advisers and human wealth advisers is the cost. Robo-advisers charge an annual fee of just 0.2-0.5 percent on the total account balance of a client. In contrast, human advisers cost up to 1 to 2 percent and extra for commission-based accounts.

These cost savings can help small and independent financial advisory firms offer a low fee structure to attract more clients.

In addition, robo-advisers can help you diversify wealth management portfolios to include sophisticated financial tasks such as tax loss harvesting, retirement planning, insurance, and real estate planning.

Pro Tip

Build a niche in the wealth management market by targeting millennials with personal wealth management strategies such as retirement planning and real estate investments.

Portfolio diversification and change in the target demographic (more millennials than Baby Boomers) means that fintech companies offer solutions that are user-friendly and can simplify the complex financial jargon.

2. Accelerates your digital transformation for a competitive edge

Small wealth management firms face stiff competition as more and more new firms crop up. On top of that, most firms are adopting fintech technology, such as robo-advisers, to be more competitive.

Digital transformation is key to surviving the competition as your target clientele is increasingly young and tech-savvy. Therefore, your offerings need to match their technical expertise and expectations without costing an arm and a leg in IT expenses.

For that reason, investing in emerging tech, such as blockchain, or expensive tech, such as enterprise resource planning (ERP) solutions, isn’t feasible on a tight budget. In this case, robo-advisers are beneficial and affordable as they are based on application interfaces such as investment management solutions.

3. Augments financial advice with human+machine model

Robo-advisers enhance the client experience with a combination of “human” and “machine” financial advice.

Upcoming wealth management clientele will be primarily made up of millennials, who use a variety of platforms including phone (20 percent), email (23 percent), and texting (8 percent) to seek financial advice. Human advice is still the most popular touchpoint at 45 percent.

Now, imagine how much more effective this human advice will be if your advisers have robo-advisers to give them accurate information and estimates? You’ll not only gain your clients’ trust with the human touch but also from the increased accuracy provided by robo-advisers advising you on the best ways to invest your clients’ money.

Small and independent financial advisory firms should work on offering a mix of wealth management solutions that combine human advice with machine advice.

Robo-advisers will run algorithms to choose the optimum investment portfolios for your clients. Meanwhile, your human advisers will get more face time with the clients to educate them and resolve their questions.

Recommended actions

Now that you’re aware of the key benefits of adopting robo-advisers and how they can transform your business, here are some steps you should take:

Identify robo-adviser platforms based on the financial planning services specific to your firm, for example platforms that focus on retirement planning, tax harvesting, or stock trading.

Use a trial version of a robo-adviser platform to test whether it has any significant business impact on your wealth management practice.

Purchase the basic plan of a robo-adviser tool that offers the financial services portfolio best suited to your business requirements. Don't immediately opt for the premium or enterprise versions without assessing your needs.

Additional resources

Check out the following GetApp resources to know what other tools you can use for wealth management and accounting:

Use our software scorecard to find the right accounting tool.

Find the right accounting software from a vast selection of accounting tools in our directory.

Rank accounting software based on features, integrations, review, etc. with our Accounting category leader board