GetApp offers objective, independent research and verified user reviews. We may earn a referral fee when you visit a vendor through our links.

Our commitment

Independent research methodology

Our researchers use a mix of verified reviews, independent research, and objective methodologies to bring you selection and ranking information you can trust. While we may earn a referral fee when you visit a provider through our links or speak to an advisor, this has no influence on our research or methodology.

Verified user reviews

GetApp maintains a proprietary database of millions of in-depth, verified user reviews across thousands of products in hundreds of software categories. Our data scientists apply advanced modeling techniques to identify key insights about products based on those reviews. We may also share aggregated ratings and select excerpts from those reviews throughout our site.

Our human moderators verify that reviewers are real people and that reviews are authentic. They use leading tech to analyze text quality and to detect plagiarism and generative AI.

How GetApp ensures transparency

GetApp lists all providers across its website—not just those that pay us—so that users can make informed purchase decisions. GetApp is free for users. Software providers pay us for sponsored profiles to receive web traffic and sales opportunities. Sponsored profiles include a link-out icon that takes users to the provider’s website.

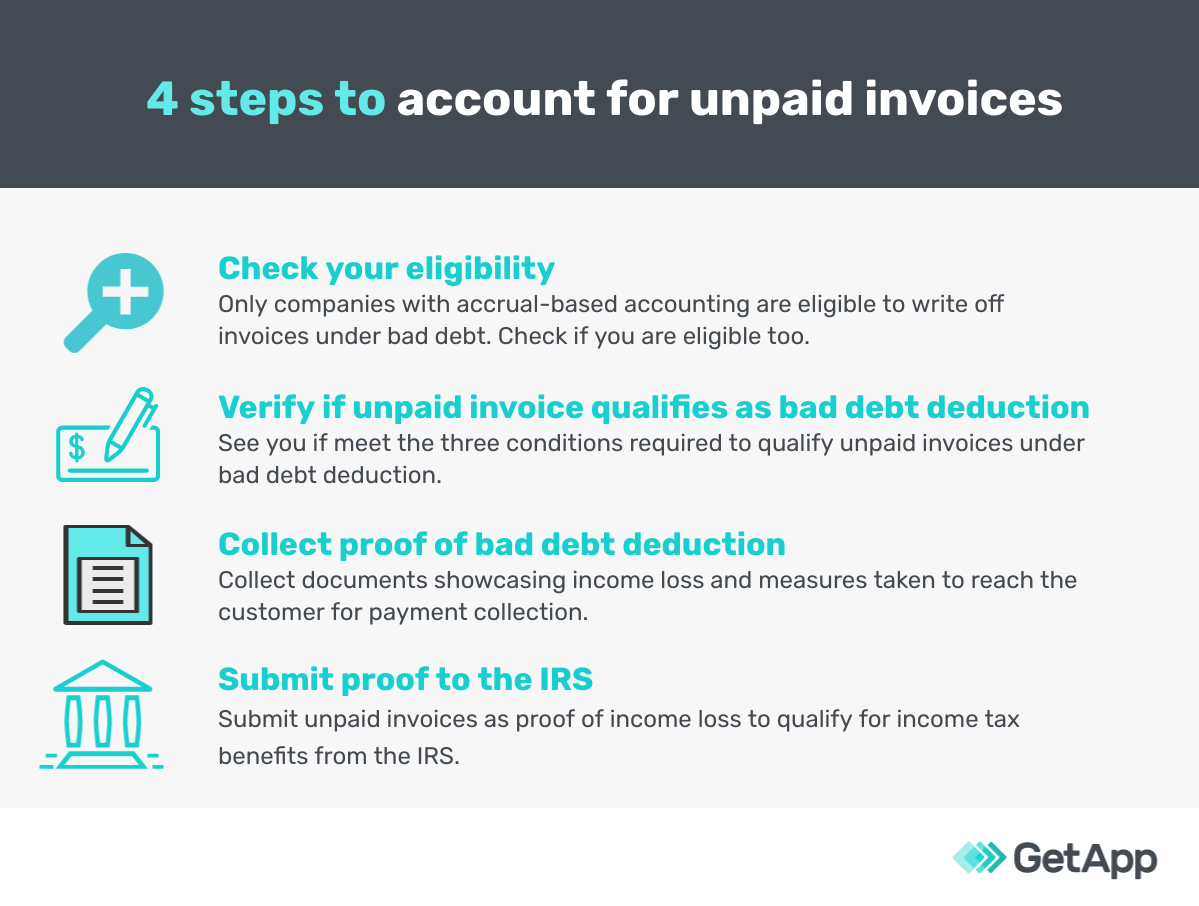

4 Steps to Account for Your Unpaid Invoices

Late payments can hurt cash flow and wreck your bookkeeping. Here's how to account for unpaid invoices correctly.

If there's one thing business leaders and their accountants hate to see, it's a high number of unpaid invoices. No matter how hard you try, there will be instances where customers won't pay on time—or at all. Some customers are slow to pay, while others suddenly go out of business.

Accumulated over time, unpaid invoices can hurt your company's cash flow. Besides making it difficult to pay your employees and vendors, inadequate cash flow can negatively impact your relationship with banks. A recent GetApp survey* reveals that 56% of small businesses were denied funding more than once in the last two years due to poor cash flow.

While you can take steps to clear an overdue payment, an outstanding invoice that just won't get paid should be accounted for in your books. This practice will help you save on taxable income and keep your business afloat during uncertain times.

Here's how to account for unpaid invoices in four steps. Following this guidance, your business can avoid cash flow problems and maintain proper financial reporting.

Steps to account for unpaid invoices

Here are the four steps to get the best possible outcome for your business when accounting for unpaid invoices:

Step 1: Check your eligibility

Traditionally, accounting consists of two types: cash basis and accrual. The difference between the two is how revenue is recorded. Cash accounting recognizes revenue only when you receive money from a client, while accrual accounting records revenue as soon as an invoice is generated.

According to the Internal Revenue Service (IRS), if you use cash-based accounting, you can't account for unpaid invoices as you didn't receive any money in the first place. [1] But if you use the accrual method and haven't been paid, you can show the invoice to prove the due amount and file the outstanding invoice under bad debt expenses.

Pro tip

Be consistent with your accounting method. Opt for accrual-based accounting, which makes submitting proofs for unpaid invoices during tax filing easier.

Step 2: Verify if your unpaid invoice qualifies as bad debt deduction

If you're eligible, the next step is to check if an overdue invoice qualifies under a bad debt deduction. [2] As a rule, you should meet the following conditions to qualify:

You must have a record of the unpaid invoice in your accounting software. Most accounting systems automatically save invoices as part of their bookkeeping feature.

You must have reported the invoice amount on your tax return. With accrual-based accounting, you can report the overdue invoice amount when filing tax returns despite not getting paid.

You must prove that the unpaid invoice is worthless and has caused economic loss for your business. In other words, you have to prove the customer hasn't paid despite repeated collection attempts.

Pro tip

Use billing and invoicing software to ease the qualification process. The tool can automatically determine an appropriate expense category for any outstanding invoice.

Step 3: Collect proof of bad debt deduction

The IRS is strict about giving tax concessions for unpaid bills. Therefore, you need to have a strong claim for eligibility.

To ensure your claim is approved, submit documents tracking your efforts to reach out to the customer. The submitted documents can include emails, faxes, and recorded virtual meetings (if available). Any contract highlighting the payment terms between you and your customer should also be shared to strengthen your claim.

Pro tip

Digitize customer communication so it's easier to collect proof for bad debt deductions. Emails and recorded virtual meetings serve as better proof than offline communication, such as in-person meetings or phone calls.

Step 4: Submit proof to the IRS

Once you have the proof, complete Schedule C (Form 1040 or 1040-SR) to report income loss from an unpaid invoice. [3] You need to list details from the invoice as "ordinary loss" under Part V of Schedule C, Other Expenses.

If you've already paid taxes for an unpaid invoice in a fiscal year, you can file an amended return using Form 1040-X. [4] If the deduction from the invoice has reduced your taxable income, the IRS will issue a refund.

Pro tip

Invest in an invoice management tool to record the details of all unpaid invoices. The software will help maintain accurate records and prevent mismatches or double entries.

How do I record unpaid invoices in my accounting system? (accrual vs. cash basis)

If your business uses the cash basis method for accounting, you only record revenue when you receive a payment. Therefore, unpaid invoices aren't recorded in your accounting system. Once an invoice is paid, you record the revenue received.

If you instead use accrual accounting (specifically, the double-accrual accounting method), your books reflect unpaid invoices in one or two accounts:

Accounts receivable: This account reflects the amounts customers owe you on unpaid invoices.

Bad debt expense: This optional account is for accounts receivable deemed uncollectible. The purpose of this account is to reflect potential future losses.

What are the tax implications of unpaid invoices?

Using accrual accounting, your business can potentially deduct unpaid invoices as bad debt expenses on tax returns. To see if your business qualifies, follow the four steps discussed above.

Remember that before you can deduct unpaid invoices, you must have proof of reasonable attempts to collect the debt. If a customer has disappeared or declared bankruptcy, you have no realistic chance of collecting in the future, and that's typically all the evidence you need.

What are effective collection strategies for overdue invoices?

Fortunately, most unpaid invoices are not the result of a customer disappearing or going bankrupt. In these cases, customers simply let invoices become overdue, and they will eventually pay. While collections can be a costly and time-consuming activity, you can take steps to improve the process.

One of the most effective strategies is to spot the warning signs of customer non payment before invoices become long overdue. Gartner found that relying on the traditional indicators of a customer's financial health is generally ineffective for predicting if they will fall behind on invoice payments. [5] These traditional indicators include:

The customer's financial ratios

The customer's credit ratings from third-party agencies

Accounts receivable aging reports

Days sales outstanding (DSO) trends

Instead, you should look for changes in a customer's industry or the economy as warning signs of possible slow payments. Behavioral changes, such as the customer returning fewer phone calls, can also indicate potential problems. In these cases, you might reduce a customer's credit limit or ramp up collection efforts before invoices become overdue.

Other effective strategies that can help reduce late payments and overdue invoices include:

Redesign your invoices so that payment due dates, terms, and contact information are clear and concise. Invoicing software with customizable templates makes it easy to update this information.

Send friendly email reminders before due dates and remind customers that there are easy ways to pay in these messages.

Accept multiple payment options, such as credit cards, electronic checks, and online portals.

Consider offering payment plans, which can make larger invoices more manageable for some customers.

How can I prevent unpaid invoices in the future?

While you may not be able to recover all unpaid invoices, it's important to know how to tackle such challenges should they arise. As discussed, you should meet specific criteria to be eligible to write off an unpaid invoice as a bad debt expense.

You can also use technology tools, such as billing and invoicing software, to digitally store invoices, receipts, credit memos, attachments, and other documents. An invoice management tool can automate the payment collection process, allowing you to focus more on fostering customer relations. Here's what else the software can do for your business:

Speed up the collection process: An invoicing tool eliminates the need to process invoices manually. It lets you set alerts for upcoming invoice deadlines and send reminders to the finance team to contact customers for payments.

Improve the chances of payment with progressive billing: Most invoicing tools facilitate progress billing, which lets you receive payments throughout the stages of a project rather than after project completion.

Automate collections via the pull payment mechanism: Invoicing tools allow you to process payments directly from a customer's bank account using a simple integration and pull payment mechanism.

Use the right tools to aid the collections process

Unpaid invoices have an outsized impact on small to midsize businesses. You need timely payments to meet your own obligations and to grow your company over time. If you use the accrual accounting method, you might be able to catch a tax break on some unpaid invoices. However, it's best to adopt strategies ahead of time to keep up with collections. Accounts payable apps and other finance software help you apply those strategies and avoid overdue invoices.

To learn more about business accounting and related software, check out these other GetApp articles:

Disclaimer: Tax laws are varied and complex. Consult with a qualified tax professional for guidance specific to your business. A tax expert or attorney can help you navigate the rules around bad debt deductions and ensure you follow proper procedures for unpaid invoices.

Sources

Publication 538 (01/2022), Accounting Periods and Methods, IRS

About Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship), IRS

1040-X Form, IRS

Survey methodology

*GetApp's Financing Survey was conducted in April 2023 among 458 business leaders at US-based small-midsize businesses with role(s) in obtaining financing within their organization. The purpose of this survey was to learn about the challenges they face attaining traditional financing options and explore if they're turning to alternative funding to finance operations, investments, etc.

Leaman Crews